Notícias

What is Bonds Payable? Definition + Journal Entry Examples

Content

These agencies classify bonds into 2 basic categories—investment-grade and below-investment-grade—and provide detailed ratings within each. A bond’s credit quality is usually determined by independent bond rating agencies, such as Moody’s Investors Service, Inc., and Standard & Poor’s Corporation (S&P). The degree to which the value of an investment (or an entire market) fluctuates.

- This same entry is made each year except that the payments will fall to $37,500, $25,000, and finally $12,500.

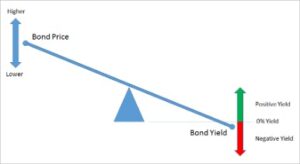

- Since the market rate is greater, the investor would not be willing to purchase bonds paying less interest at the face value.

- The interest expense is amortized over the twenty periods during which interest is paid.

- If you are new to HBS Online, you will be required to set up an account before starting an application for the program of your choice.

- The excess $100 is classified as a premium on bonds payable, and is amortized to expense over the remaining 10 year life span of the bond.

- Bonds can also be divided based on whether their issuers are inside or outside the United States.

Moreover, the “payable” term signifies that a future payment obligation is not yet fulfilled. Bonds Payable are a form of debt financing issued by corporations, governments, and other entities in order to raise capital. In this case, the interest accrual is for the entire 6-month period because the last interest payment was on 1 July. Because bonds can be issued on an interest date or between interest dates, both cases will be discussed.

How to Record Bonds Payable Accounting?

Investments in bonds are subject to interest rate, credit, and inflation risk. High-yield bonds (“junk bonds”) are a type of corporate bond with low credit ratings. Some agencies of the U.S. government can issue bonds as well—including housing-related agencies like the Government National Mortgage Association (GNMA or Ginnie Mae). Since the book value is equal to the amount that will be owed in the future, no other account is included in the journal entry.

Suppose that the Valenzuela Corporation issues $100,000, 5-year, 12% bonds on 1 March 2020. The bonds, dated 2 January 2020, pay interest semiannually on 2 January and 1 July. These problems are alleviated by the fact that the accrued interest is collected from the investors when https://kelleysbookkeeping.com/ the bonds are sold. When this occurs, investors pay the issuing corporation for the interest that has accrued since the last interest date. The interesting aspect of TIPS, that differs from bonds and notes, is that the principal goes up and down with inflation and deflation.

Recording Interest Payments

Intermediate Financial Accounting 2 Copyright © 2022 by Michael Van Roestel is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted. After submitting your application, you should receive an email confirmation from HBS Online. If you do not receive this email, please check your junk email folders and double-check your account to make sure the application was successfully submitted. Our easy online application is free, and no special documentation is required. All applicants must be at least 18 years of age, proficient in English, and committed to learning and engaging with fellow participants throughout the program.

The difference in the stated rate and the market rate determine the accounting treatment of the transactions involving bonds. It becomes more complicated when the stated rate and the market rate differ. For example, a company is issuing a bond at $10,000 for a premium of $500. The premium is recorded on the bonds payable account entry as a credit of $500.

Understanding Carrying Amount of Notes Through Journal

If the amounts of interest expense are similar under the two methods, the straight‐line method may be used. A convertible bond is a debt instrument that has an embedded option that allows investors to convert the bonds into shares of the company’s common stock. At its most basic, Valuing Bonds Payable the convertible is priced as the sum of the straight bond and the value of the embedded option to convert. Both stocks and bonds are generally valued using discounted cash flow analysis—which takes the net present value of future cash flows that are owed by a security.

This is because investors are seeking the best interest rate for their investment. If the stated rate is higher, the bond issuance is more desirable, and the investors would be willing to pay more for this investment than for another with a lower stated rate. The accounting for bonds purchased at a premium follows the same method as was illustrated for bonds at a discount.

Tax Policy

The calculation for notes payable, with interest, is the face value – the portion of the note repaid. The carrying value of a bond is the equivalent of the bond’s face value plus any unamortized premiums. The carrying value of a bond can also equal the bond’s face value minus any unamortized discounts. The carrying value can also be referred to as the carrying amount or book value. In most cases, bonds are rarely sold at face value to investors because interest rates change so frequently. To illustrate, on May 1, 2021, Engels Ltd. issued 10-year, 8%, $500,000 par value bonds with interest payable each year on May 1 and November 1.

They will pay more in order to create an effective interest rate that matches the market rate. The issue price of a bond is based on the relationship between the interest rate that the bond pays and the market interest rate being paid on the same date. The basic steps required to determine the issue price are noted below. The present value of a bond is calculated by discounting the bond’s future cash payments by the current market interest rate. When a company issues bonds between interest dates, they are selling those bonds for their par value or face value.

During the life of the bond or note, you earn interest at the set rate on the par value of the bond or note. This page explains pricing and interest rates for the five different Treasury marketable securities. From ETFs and mutual funds to stocks and bonds, find all the investments you’re looking for, all in one place. A type of investment with characteristics of both mutual funds and individual stocks. ETFs are professionally managed and typically diversified, like mutual funds, but they can be bought and sold at any point during the trading day using straightforward or sophisticated strategies.

- Each share of stock is a proportional stake in the corporation’s assets and profits.

- Straight-line amortization results in varying interest rates throughout the life of the bonds because of the equal amount of the discount applied at each interest payment date.

- It’s important that the discount, premium, and issue costs have been amortized properly up to the moment when the book value of the bonds is needed.

- Let’s use the following formula to compute the present value of the maturity amount only of the bond described above.

- Suppose that the Valenzuela Corporation issues $100,000, 5-year, 12% bonds on 1 March 2020.

See Table 3 for interest expense and carrying value calculations over the life of the bond using the straight‐line method of amortization . Finance Strategists is a leading financial literacy non-profit organization priding itself on providing accurate and reliable financial information to millions of readers each year. The result is that there is a zero balance in the Interest Payable account and a $4,000 balance in the Interest Expense account.